You work hard. You deserve

transparent lending.

easy lending.

instant lending.

inspired lending.

human lending.

Cannabis, Hydroponics, and Hemp Debt Capital is just a few clicks away.

Apply from any device.

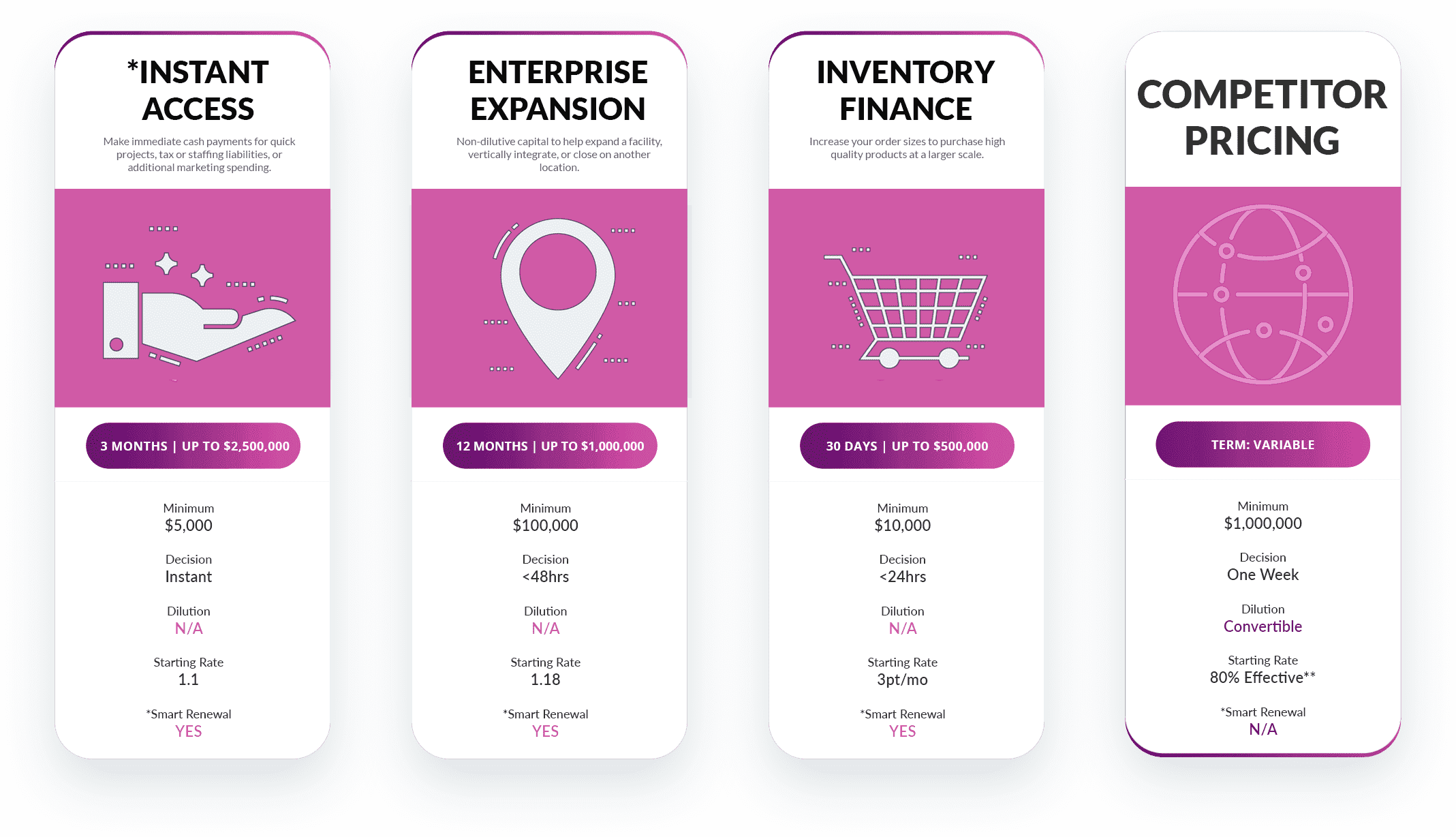

Products

Borrow what you need, when you need it.

Instant Access

3 months | Up to $150,000

Make immediate cash payments for quick projects, tax or staffing liabilities, or additional marketing spending.

Enterprise Expansion

4-12 months | Up to $1,000,000

Non-dilutive capital to help expand a facility, vertically integrate, or close on another location.

Inventory Finance

20-75 days | Up to $500,000

Increase your order sizes to purchase high quality products at a larger scale.

A Fully Transparent Lending Experience

Flexible funding at your finger tips. In seconds.

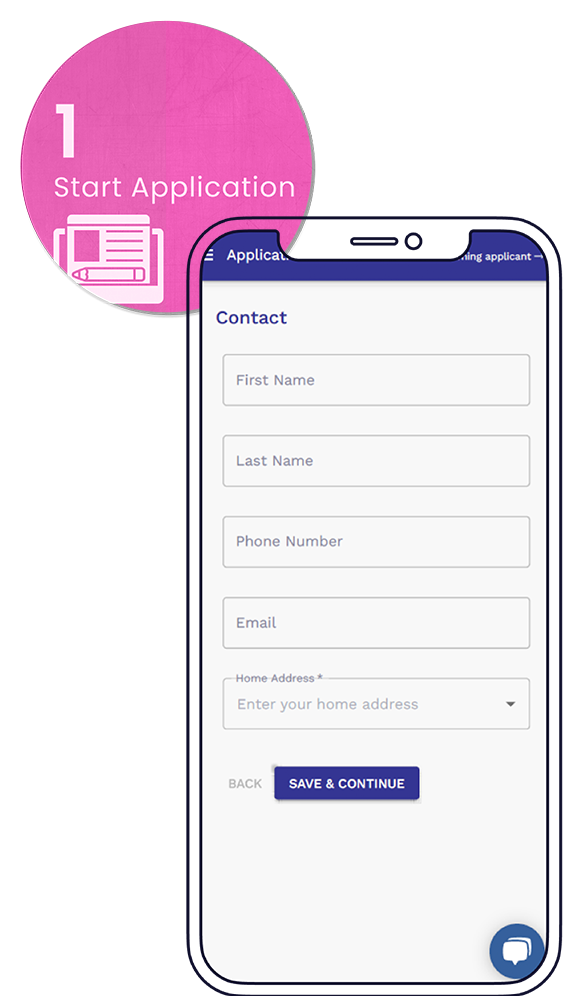

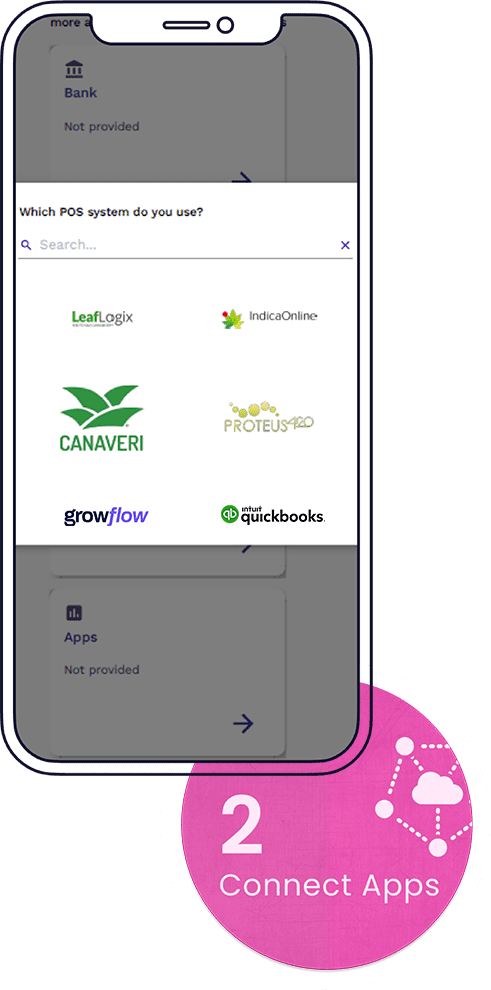

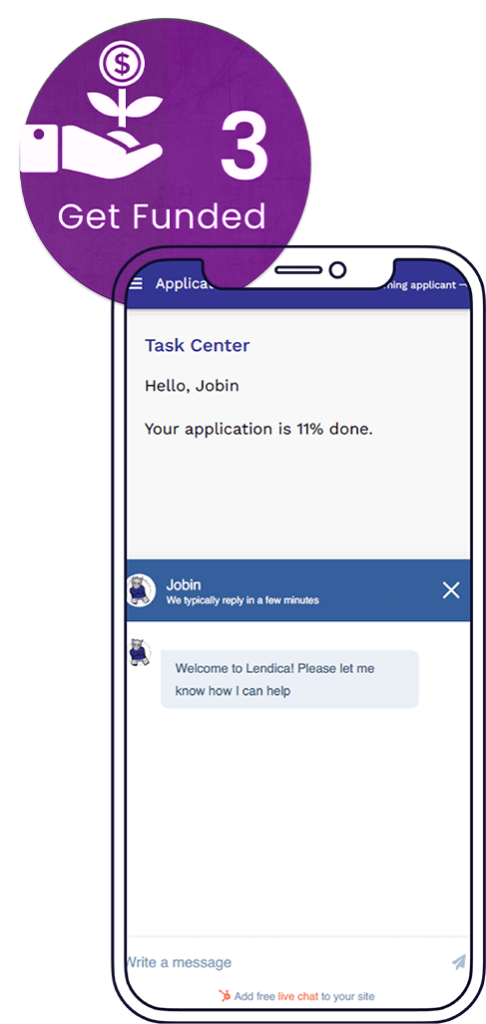

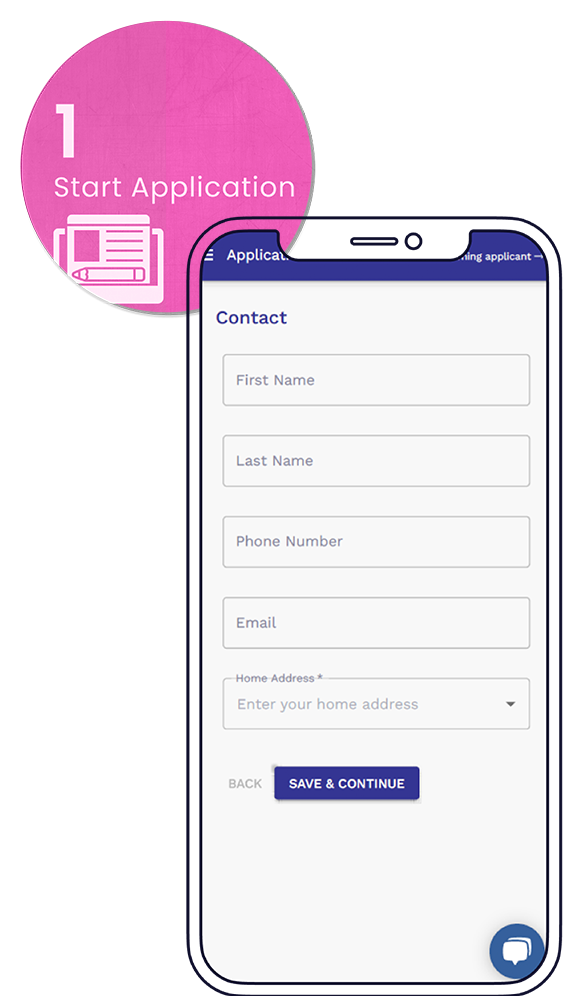

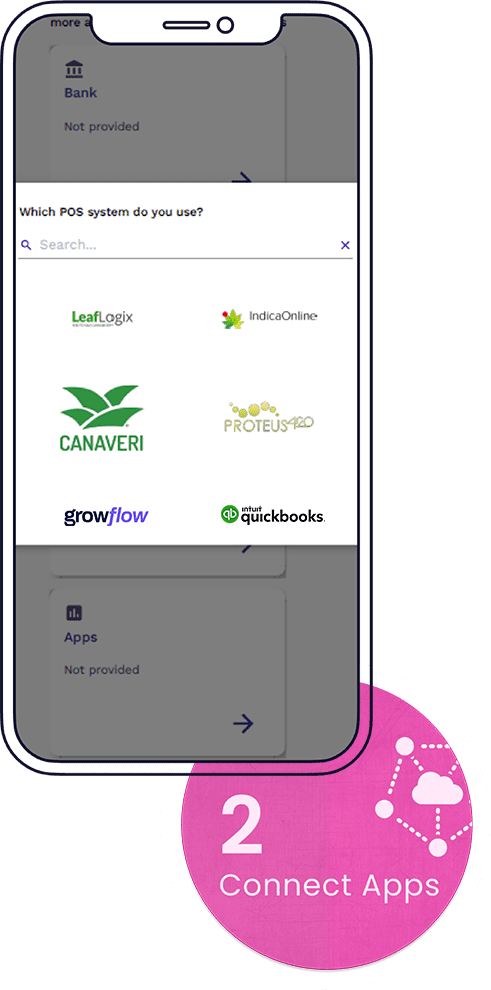

The Process

Process

Pricing

Frequently Asked Questions

Visit our resource center for more information

When you submit your application, the Lendica underwriting model starts cranking. We will immediately reach out with next steps regarding your credit, system integration, and more.

Lendica partners with private credit investors that have expertise in small business lending markets. These lending partners work with Lendica to qualify good borrowers and get capital to them quickly.

Lendica is focused on providing efficient and cost-effective capital markets. Borrowers may be subject to an origination fee only upon issuance of your working capital. It is absolutely free to apply!

Lendica may require its borrowers to provide Experian FICO scores. In the event that a hard credit pull is required, your FICO score may be impacted.

Lendica’s edge is its ability to quickly underwrite, deploy, and collect on your working capital. Businesses that do not currently have technology to accept debit card transactions can apply below.

Yes! Lendica prides itself on being fully transparent throughout the underwriting process. If you for whatever reason do not qualify, we will gladly share why and work to help you next time around!